The Travel Insurance Problem you didn’t Know About (+Solution)

I consider myself to be someone who has done a fair amount of travel during his lifetime. I am also someone who always wants to make the most out of every trip (and be well-prepared for it). That sometimes includes changing plans, places, even countries in just a matter of days. And believe me, that is not always as easy as it might sound.

In this piece, I’ll be covering a topic that is not often talked about, but I believe it should. I am talking about how our insurance travel plan often affects our travels (sometimes without even knowing), and how you can find a flexible travel insurance plan that will be able to adjust to your needs as a traveler or a digital nomad.

The Importance of Travel Insurance

While traveling, my health (both physical and mental) is always my number one priority. I would generally consider myself an anxious person. I’ve struggled a lot with anxiety in my life (I still do), and I am slowly taking steps to overcome that. Obviously, this has affected my travel plans as well.

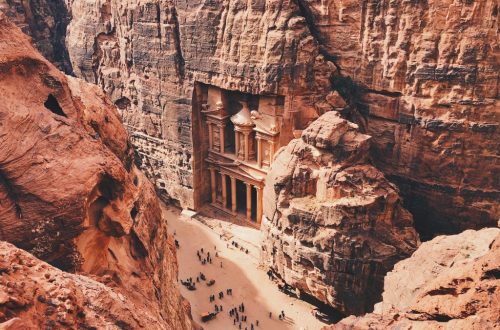

I’ve felt the need to change plans more than just a few times in accordance with what my body and mind tell me. Remembering a (bad) joke I made in my article on whether Travel Insurance to Jordan is needed, wherever you find yourself in the world, there is always the possibility of a flowerpot landing on your head.

For example, while exploring Georgia, we decided that we were too tired and frustrated (because we were trying for around 2 hours to find a taxi with reasonable pricing) to continue our multi-day trip around the country and spontaneously booked a bus ticket to return to the capital city, Tbilisi, and then back home.

Things like this can happen. I am sure it has happened to many of you as well. However, changing plans early or not knowing what your next step will be (If, for example, you are a digital nomad) creates a (for me) unnecessary struggle: Keeping up with your Travel Insurance plans.

Don’t get me wrong, travel insurance is something every traveler needs. It is the key to avoid extremely high health-related costs, should the unexpected happen. From injuries to illnesses, it is a savior for any traveler. I, myself (even when visiting the troubled lands of Syria), have never traveled abroad without a flexible travel insurance plan. However, the point is in the little details. You see the term that I just used? Flexible.

The Struggle

The thing is most of the travel insurance companies usually require you to have a return ticket in order to provide you with a plan. In fact, many of them do not cover travels on one-way ticket. This can create many troubles if you are a nomad, or someone that wants to travel with ultimate flexibility. Sounds pretty horrible, doesn’t it?

It has happened to me as well, and I’ve always ended up being afraid of something happening and not being covered. And let’s not talk about countries like Egypt, where having a travel insurance plan is mandatory in order to even be allowed to enter the country.

Fear and anxiety are counter motives to travel. I’ve found myself not enjoying trips and missing out of creating lifelong memories due to that. We are humans, we need to feel safe in order to be ourselves. I believe that the insurance plan should serve the traveler or digital nomad and not the other way around.

The Solution

Don’t worry though, I think that I have managed to find a solution to this problem. When doing my research, I stumbled upon Nomad insurance by Safetywing, and I was really fascinated by their project. They offer a flexible, monthly-paid travel insurance. What does that exactly mean?

It basically means that you can pay monthly, travel indefinitely, and explore anywhere in the world without needing to specify your next destination. Are you planning to travel for 5, 7, 15, 30, or 60 days? You do not know how much time you will spend away from home? Are you a digital nomad? You are covered!

The only extra cost is when you travel to the U.S, because things get a little bit more complicated (still very easy, though). In order to use their services for travel to the US, you will need to choose a special add-on that was made for this exact purpose.

Nomad Insurance is built by nomads, for nomads, so, of course, you’re covered even if you don’t have a return flight. However, if you are not a nomad, but appreciate ultimate flexibility during your travels, then Nomad Insurance might save you from a lot of hassle. You can check some of their flexible travel insurance plans through this link. Believe me, it’s worth the time!

Furthermore, in my opinion Safetywing’s Nomad Insurance is one of the good travel insurance options available out there. With a maximum coverage of 365 days, they are a great option whether you are a Nomad or not! They offer budget friendly rates but combine it with excellent coverage and immediate support (I have never waited more than a few minutes to get an answer from them!).

The best part? Nomad Insurance can be purchased even if you have left your home country already, making it extremely flexible. Lastly, they also cover extreme sports, something that can come in very handy if you are an adventurous soul. I’ve personally not seen many travel insurance companies that cover sports.

Final Thoughts

I personally believe that flexibility is the key when traveling or working as a digital nomad. You never know what will happen to you, but, in my personal opinion, you have to do everything in order to make sure that you are prepared for the worst-case scenario.

Plans continuously change, that’s natural. That’s a sure thing if you are a nomad. That’s why I trust Safetywing’s flexible travel insurance. You pay Monthly and the whole procedure is simple and straightforward. It has lifted a lot of weight out of my back, and I am really thankful for that.